Risks per asset

This framework offers a quantitative approach for evaluating the risk level of various assets. Scores from this assessment enable governance to further evaluate and assign an appropriate Asset Risk Grade — Low Risk, Medium Risk, or High Risk. This classification impacts borrowing conditions. Below is a table summarizing the risk grades for each asset.

Money market risk tiers are subject to change, with possible upgrades or downgrades.

| Asset Name | Token | Risk Grade |

|---|---|---|

| Ethereum | ETH | Low Risk |

| Wrapped stETH | wstETH | Low Risk |

| USD Coin | USDC | Low Risk |

| Tether | USDT | Low Risk |

| Dai | DAI | Low Risk |

| Chainlink | LINK | Medium Risk |

| Band Protocol | BAND | Medium Risk |

| Shiba Inu | SHIB | Medium Risk |

| Beta Finance | BETA | High Risk |

| Pepe | PEPE | High Risk |

| Memecoin | MEME | High Risk |

Risk Parameters

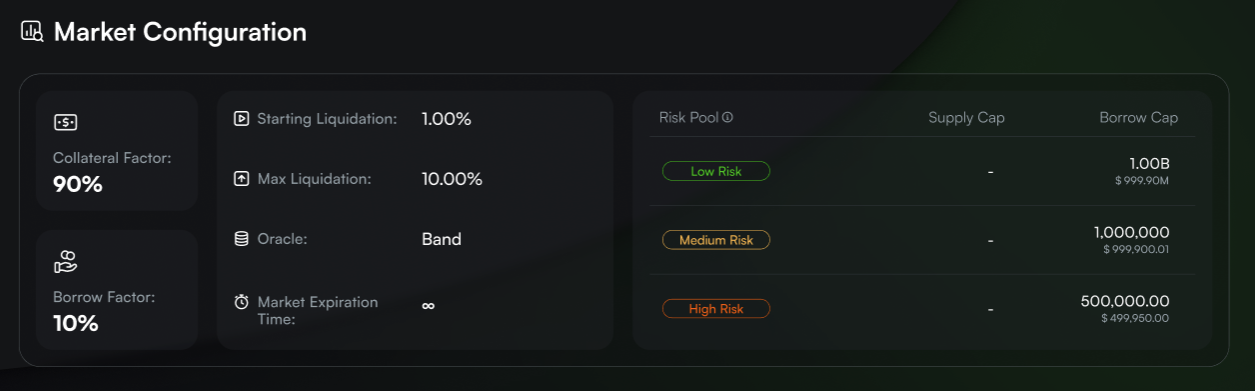

Omni integrates these risk assessment results to establish individual risk profiles for assets, determining specific parameters such as the Collateral Factor (CF), Borrow Factor (BF), expiration date, and various liquidation metrics for each token.

| Token | Collateral Factor | Borrow Factor | Expiration Timestamp | Starting Liquidation Bonus | Max Liquidation Bonus | Liquidation Bonus Kink | Expired Liquidation Bonus | Soft Threshold |

|---|---|---|---|---|---|---|---|---|

| ETH | 89% | 90% | NEVER | 1.5% | 5% | 7.5% | - | 125% |

| wstETH | 89% | 90% | NEVER | 2% | 8% | 7.5% | - | 125% |

| USDC | 92% | 93% | NEVER | 1% | 5% | 7.5% | - | 120% |

| USDT | 88% | 89% | NEVER | 1.5% | 5% | 7.5% | - | 120% |

| DAI | 90% | 91% | NEVER | 1.5% | 5% | 7.5% | - | 120% |

| LINK | 75% | - | June 24, 2024 | 3% | 10% | 7.5% | 3% | 130% |

| BAND | 75% | - | June 24, 2024 | 3% | 10% | 7.5% | 3% | 130% |

| SHIB | 70% | - | June 24, 2024 | 3% | 10% | 7.5% | 3% | 130% |

| BETA | 60% | - | February 25, 2024 | 3% | 10% | 7.5% | 3% | 130% |

| PEPE | 40% | - | January 28, 2024 | 5.5% | 15% | 7.5% | 5% | 140% |

| MEME | 30% | - | January 28, 2024 | 6% | 15% | 7.5% | 5% | 140% |

Supply Caps & Borrow Caps

Omni has strategically set Supply Caps for non-borrowable assets, particularly those that are riskier or less liquid, to mitigate exposure and manage the protocol's overall risk. Conversely, Borrow Caps are in place for borrowable assets, tailored to their risk pools. These caps are vital for maintaining liquidity within the protocol. Information regarding the Supply and Borrow Caps for each asset can be conveniently found on the Analytics page.

Supply Caps

The following table outlines the Supply Caps set for each asset:

| Token | Supply Cap |

|---|---|

| ETH | No Cap |

| wstETH | No Cap |

| USDC | No Cap |

| USDT | No Cap |

| DAI | No Cap |

| LINK | 500,000 |

| BAND | 1,000,000 |

| SHIB | 500,000,000,000 |

| BETA | 20,000,000 |

| PEPE | 1,000,000,000,000 |

| MEME | 69,420,000 |

All values are represented in the respective token units. 'No Cap' indicates that there is no upper limit set for the supply of that token.

Borrow Caps for Each Risk Pool

The table below details the Borrow Caps for each risk pool:

| Token | Low Risk Pool | Medium Risk Pool | High Risk Pool |

|---|---|---|---|

| ETH | 2,500 | 1,000 | 500 |

| wstETH | 1,000 | 500 | 250 |

| USDC | 5,000,000 | 2,000,000 | 1,000,000 |

| USDT | 5,000,000 | 2,000,000 | 1,000,000 |

| DAI | 5,000,000 | 2,000,000 | 1,000,000 |

All values are represented in the respective token units.

This structure ensures a balanced and cautious approach to asset management within the Omni protocol.