Introduction

Welcome to Omni

As DeFi investors, we often strive for better returns, enhanced control, and greater flexibility in our financial endeavors. The current landscape of lending platforms, however, presents several challenges:

- Unfavorable loan configurations

- Liquidity fragmentation

- Yield dilution

- Limited market diversity

- Restrictive lending and borrowing options

(For an in-depth look at the current protocol limitations, explore our analysis here.)

That’s why Omni has emerged. Omni steps onto the scene as a transformative force, poised to redefine the DeFi space with a money market system that's as dynamic as it is user-centric.

👩🌾 For Lenders

- Personalize your loan risk appetite.

- Experience zero liquidity fragmentation.

- Organize your investments using subaccounts for clear, compartmentalized positions.

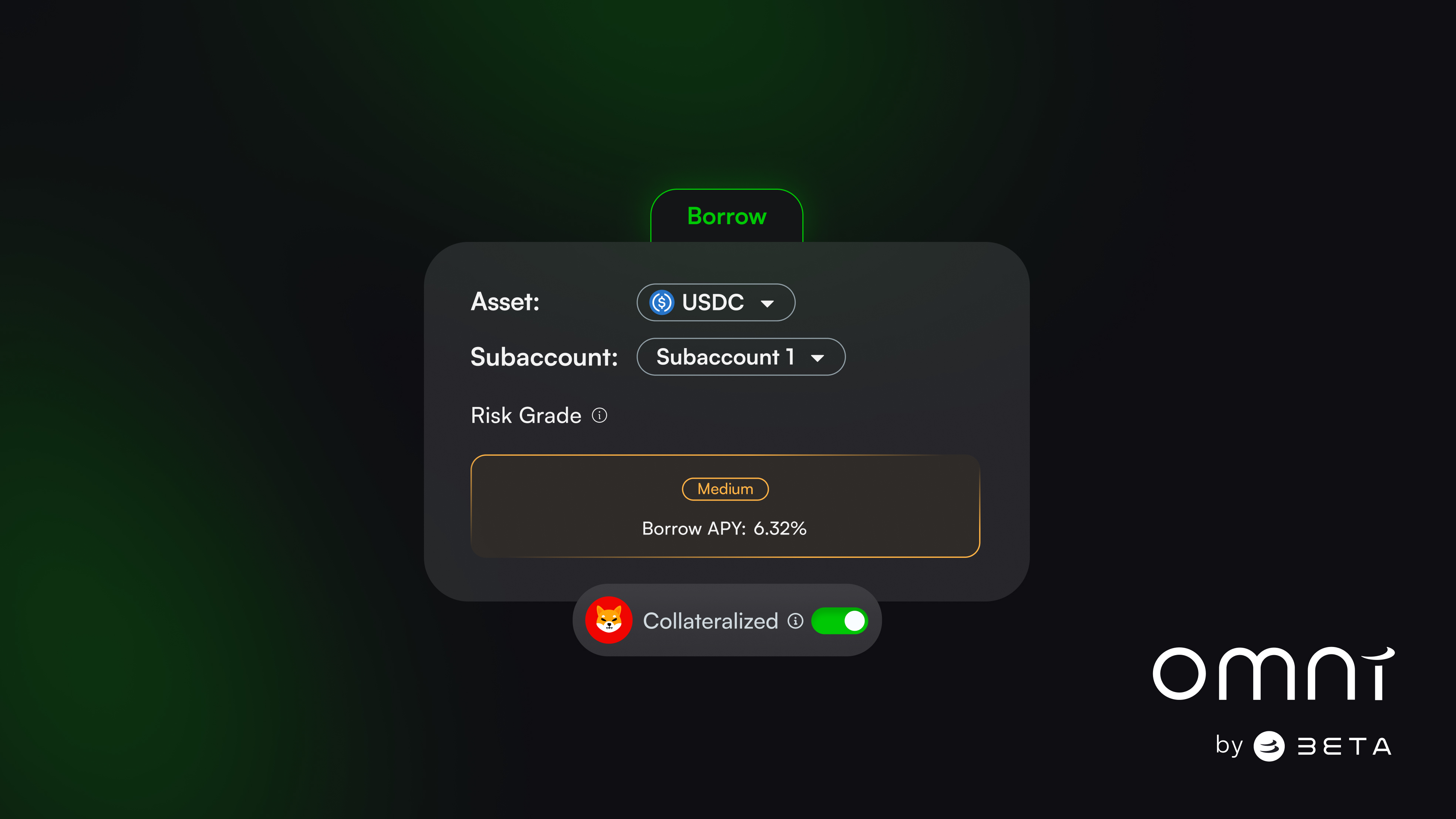

🤝 For Borrowers

- Borrow against a diverse range of collateral types, including long-tail assets like SHIB, stablecoins, LSDs, and more!

- Enjoy the convenience of borrowing multiple assets simultaneously from a single wallet.

Risk Pools and Risk Grade: A Dual Innovation

Risk Pools: Empowering Lender Choices

- Choose your preferred risk level for collateral when making deposits.

- Earn higher yields by opting for loans backed by riskier collateral.

- Choose to deposit in high-risk pools for higher APY or opt for low-risk pools for more secure investments.

- Depositing into a higher-risk pool allows you not only to gain exposure to higher yields but also to benefit from the interest generated by lower-risk pools, ensuring efficient use of capital without fragmentation.

Risk Grade: Borrowing with Any Grade of Assets

- Each asset is assigned a risk grade based on thorough risk assessment. (For more details, see here).

- The risk grade influences collateral asset loan configurations, including borrow APY, LTV ratios, liquidation terms, and more.

- Enables listing of a wide range of assets, from mainstream to long-tail, enhancing capital efficiency even for lesser-known coins.

Additional Features for Enhanced Lending Experience

- Gasless Subaccounts: Enable efficient asset management without incurring gas fees.

- E-Mode: Optimizes your borrowing power with enhanced conditions.

Omni's Unique Features

- Collateral Expiration Dates: Timed asset listings to adapt to dynamic market conditions.

- Dynamic Soft Liquidations: Tailored to cater to the varying risk levels of assets and to ensure capital-efficient liquidations.

Join Omni for a transformative DeFi experience where inclusivity, efficiency, and personalization are at the forefront of your financial journey.